Real Property/Reappraisal FAQs

Real Property FAQs

An appraiser's card was left on my door. Why were they here?

If our office has received information from City/County Inspections regarding the issuance of a building permit or if you have recently filed a real estate appeal, one of our staff appraisers may have visited your property.

Are your measurements OUTSIDE or INSIDE?

Measurements are taken from the outside.

Do I need to be home when an appraiser visits?

You do not have to be home when an appraiser visits your home unless there is a need to have access to the inside. If that is the case, an appointment will be made prior to the visit.

Do you physically measure the dwelling or use plans?

Exterior measurements are physically conducted. If plans are available, appraisers compare them to the information they have obtained.

How can I determine how much the taxes will be for a newly constructed home?

It is best to have your closing attorney calculate taxes based on the sale price of the property. However this will be an estimate only, and will not be the actual tax bill amount.

How can I file an appeal?

There are two options: 1. File online through the Tax Help portal (recommended) 2. File a paper appeal form. Or call (919) 560-0300"Call: (919) 560-0300" to request an appeal form to be mailed to you. Your appeal must be filed by 5:00 p.m. on the date The Board of Equalization and Review adjourns, which is June 16, 2025, or within 30 days of a Change of Value Notice.

How do I appeal online?

Visit our online portal at Tax Help to review your property characteristics, to compare your appraised value with the actual sale prices of properties similar to yours, and to file an appeal.

How do I determine square footage for individual condominium units?

This information can be obtained by calling our customer service Call Center at 919-560-0300 and requesting to speak with our Real Property Appraisal Division.

How do I find a land/building breakdown for condominium values?

Land is not separately priced on condominiums. Land value is inherent in the assessed value of the unit.

How often are reappraisals done? When is the next one?

According to NC General Statute 105-286 each of North Carolina's 100 counties must revalue property at least once every eight years; however that cycle can be advanced by resolution of the county's governing body (County Commissioners). Durham County's most recent revaluation was effective January 1, 2025. Next reappraisal will be January 1, 2029.

I have three (3) bedrooms in my home. Your system says four.

The number of bedrooms is a descriptive field that does not change value. To ensure our data is correct contact our Call Center at 919-560-0300 and request that your property data be updated. Once we have received your information, it will be forwarded to the Appraisal Division to be corrected for the new appraisal year.

I no longer own this piece of property.

The ownership of real property is determined annually as of January 1. If you have received written communication from the TaxOffice and you are no longer the owner, please forward the correspondence to the current owner.

How do I change my address with your office?

Click Change of Address Form to change your address online.

If my value is lowered, can I get a refund for prior years?

We are not allowed to refund prior years. NC General Statute 105-287 states, 'An increase or decrease in appraised value made under this section is effective as of January 1 of the year in which it is made and is not retroactive'. In other words, the change can only be made effective for that year going forward.

Is land valued using deeded or mapped acres?

Mapped (or calculated) acreage is a more accurate determination of the actual acreage; therefore, we use mapped acres as one means of valuing land.

My home is not worth the value you have it assessed for. How is this value determined?

The tax office values property based on 100% fair market value as of the effective date of the last reappraisal. When determining the assessed value of a property there are several factors considered. Among those is age of dwelling, square footage, property type, quality of construction, as well as the location of the property. Staff appraisers closely review sales of comparable properties within the same local area.

The square footage on my fee appraisal is different from tax records.

Our square footage will be different because we use outside dimensions and fee appraisals generally measure each room individually and use a cumulative total.

What are the requirements for the Present-Use program?

There are three (3) classifications of property that may qualify for the Present - Use Program; they are Agriculture, Forestry and Horticulture. Property coming within one of the three following classes may be eligible for Present-Use if a timely and proper application is filed. 1. AGRICULTURE -Individually owned agriculture land consisting of one or more tracts, one of which consists of a least 10 acres that are in actual production and for the (3) years preceding January 1 of the year for which benefit is claimed, have produced an average gross income of at least one thousand dollars ($1000.00) 2.HORTICULTURE-Individually owned horticulture land consisting of one or more tracts, one of which consists of at least 5 acres that are in actual production and that for the three years preceding January 1st of the year in which the benefit is claimed, have produced an average gross income of at least one thousand dollars ($1000.00) 3.FORESTRY - Individually owned forestland consisting of one more tracts, one of which consists of at least 20 acres that are in actual production and are not included in a farm unit.

What are valid sales that I can submit to support my opinion of value?

Generally, for the January 1, 2025 reappraisal cycle, sales that occurred in 2023 or 2024 could be considered, provided that the sales are for properties that are comparable to yours in terms of features and location. The term "market sale" typically does not include transactions that occur between related parties, or that are the result of a foreclosure sale, short sale, or auction.

What if my land does not pass the percolation (perk) test, and has not in years?

The land must be tested by the Health Department or private soil scientist. Once we receive a copy of the perk report, we will review your value. If the value is reduced, it will be for current year forward. It is not retroactive.

What is Comper?

Comper is an online residential property comparison tool. It provides basic information for your property, and for similar properties in your area. Comper displays qualified sales from the present appraisal period (2023 through 2024). This period reflects sales prior to the most recent general appraisal (January 2025). Comper can generate a comparison report which can be saved and printed. Comper is used in conjunction with our Appeal Resolution Center. Both of these online tools can be accessed through our online portal, www.dconc.gov/taxhelp.

What is the Board of Equalization & Review?

The Board of Equalization and Review a 'special board' composed of five Durham County citizens appointed by the Board of County Commissioners to serve in their stead. The Board of E & R exists to hear taxpayer appeals with respect to the listing and appraisal of property. Each Commissioner appoints one Board member.

When can I appeal?

You can file an appeal in any tax year. To be considered for the current tax year, your appeal must be filed before the Board of Equalization and Review adjourns. The official adjournment date will be published in the Durham Herald-Sun and on the county website. For 2025 appeals, the Board's adjournment date is June 16, 2025 at 5:00 p.m.

When does the appraiser visit my home to appraise it?

In a non-reval year, an appraiser could visit your property for any of the following reasons; 1). Change to property triggered by the issuance of a building permit(new construction, additions, or demolition) 2). Review of property due to land modification (parcel split or recombination) 3). Verification of physical characteristics in preparation for an appeal to the Board of Equalization and Review. 4). Transfer or sale of the property.

Why is sale price for my house more than your assessed value?

The tax-assessed value is based on 100% market value as of the last general reappraisal, effective January 1, 2025.

Will my current fee appraisal, HUD statement, or refinance be enough to lower my value?

This information can certainly be considered. Appraisals would need provide an opinion of value for a date that is reasonably close to January 1, 2025. Individual sale prices could be considered, but keep in mind that a single sale may not be reflective of the typical expected market sale price.

Reappraisal (Revaluation) FAQs

Are there any circumstances in which values would change before the next reappraisal?

There are a few important circumstances in which a tax value would change before the next reappraisal. These include new construction or a change in zoning. When either of these occurs to an individual property, its market value is adjusted using the rates developed for the most recent reappraisal year. For example, if a house is built in 2026 on a lot that was vacant in 2025, the new house and lot will be appraised using January 1, 2025 market values.

Do I need to attend my appeal hearing?

You can appear in person before the Board of Equalization and Review, but it is not required. If you are unable to attend on the date and time set by the Clerk to the Board, your case will still be heard. The Board will review all submitted documentation regarding your case and mail you a decision.

How are appraisal and taxation related?

Appraisal and taxation are separate issues. The county Tax Assessor determines the market value, but the county tax rate has no impact on the valuation process. Each taxing jurisdiction—the county commissioners, city council, etc.—establishes its own tax rate. The final tax bill cannot be determined until these rates are set.

How can I appeal?

Before you submit a formal appeal, and to avoid a formal hearing, we ask that all homeowners verify their property data at http://www.dconc.gov/taxhelp. If you find out-of- date or incorrect property information, submit your updates online or call us at 919-560-0300. Our call center staff can submit or correct property information on your behalf. If all information is up to date and you still want to appeal, visit http://www.dconc.gov/taxhelp and select Step 3. You can file an appeal online or with a paper form. It is important to submit your appeal well before the June 16, 2025, deadline.

How can I view the information you have on file for my property?

Visit http://www.dconc.gov/taxhelp. Type in your REID number and click “Submit to Review & Compare.” Go to Step 1 where you can review the information we have on file and, if you notice any of the information is incorrect, request changes. You can request changes by clicking on the “Request Property Change” button and providing the updates along with your contact information. You can also call us at 919-560-0300 to have one of our staff members take your information.

How do I know if I should appeal?

Durham County Tax Administrators are committed to working with all property owners to ensure that every property is appraised at a reasonable estimate of its January 1, 2025 market value. If you believe the 2025 appraised value of your property is not a reasonable estimate of what it could sell for on January 1, you have the right to appeal the value.

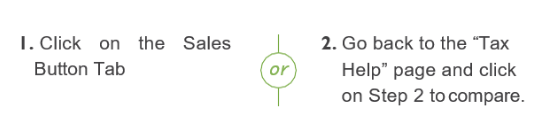

If you’re considering an appeal, we recommend first visiting http://www.dconc.gov/taxhelp. Type in your REID number and click “Submit to Review & Compare.” Go to Step 1 where you can review the information we have on file for your property. To review information for similar properties you can either:

The Sales Button Tab will provide a list of Sales you’re your Market Area. Once you get to the “Compare” page, you can refine the results by clicking on the buttons across the top of the map. While we understand some taxpayers may have concerns about affordability and changes in property tax amounts, these are not grounds for an appeal.

How do I qualify for property tax exemptions?

Exemptions have a range of eligibility requirements. To see if you qualify, visit http://www.dconc.gov. Click on Departments, and then“Tax Administration”. Choose “Property Tax Relief Programs” from the menu on the left. If you have any questions regarding exemptions, please call us at 919-560-0300.

How does reappraisal benefit homeowners?

Property taxes are based on property values. Without periodic reappraisals, some property owners would pay relatively more while others would pay relatively less. Reappraisal resets property values to their current market value so that the property tax burden is equitable for all taxpayers.

How long do appeal reviews take?

Appeal reviews could take anywhere from 30–120 days and largely depend on how many appeals are filed in a given neighborhood. If there are a large number of appeals in a particular neighborhood, then the process may take longer than in a neighborhood with fewer appeals. The Tax Administration Office will always respond to appeals as quickly as possible.

What are the qualifications of your appraisers? How are they trained?

All Durham County appraisal staff members are certified to perform property tax appraisals by the NC Department of Revenue. The Tax Administration Office staff is both well-trained and professional, with decades of combined experience. Our appraisers must pass a series of educational courses and a comprehensive examination to meet certification requirements. They also have ongoing educational and training requirements.

What is market value?

Market value is the most probable price a property would bring in an open and competitive market. The Durham County Tax Administration Office does not create market value; rather, we analyze the patterns and trends of the local real estate market and use that information to estimate market values for all properties.

What is reappraisal? How does it work?

Reappraisal (also known as revaluation) is a process that resets the taxable value of all real property to its current market value. This includes vacant and improved land, whether residential, commercial, agricultural or industrial.

We have a professional reappraisal staff that is both trained and certified in real property tax appraisal by the NC Department of Revenue. To ensure our assessments are accurate, every recorded sale of property in Durham County is evaluated through a combination of computer-based reviews and field reviews. This ensures the characteristics of each property are accurately reflected in county tax records. As part of this review, all residential and commercial properties have been digitally photographed in high resolution to ensure that all improvements can be compared uniformly. This process also validates property addresses and locations to assist emergency responders.

Why is Durham County reappraising property values?

North Carolina (via General Statute 105-286) requires all counties to conduct a reappraisal at least once every eight years. Durham County’s last reappraisal was performed in 2019. The goal of reappraisal is to help ensure the county’s tax burden is distributed equitably based on current property values.

Why is the reappraisal cycle being shortened from eight years?

An eight-year cycle, for a fast-growing county like Durham, creates more opportunity for inequities to grow and usually leads to much larger and unpredictable changes to property values. A shorter cycle reduces the chances of this happening and helps make property taxes more equitable, predictable, and manageable.

Will my tax bill change?

Not necessarily. The annual tax bill for each property is calculated by multiplying the tax value by the tax rate, which is determined each year by each taxing jurisdiction—the county commissioners, city council, etc. Some tax bills will go up, some will go down, and some will stay about the same.

When will the reappraisal occur? When will it take effect?

The effective date for the Current reappraisal is January 1, 2025. A notice of value change will be mailed to taxpayers prior to the convening of the Board of Equalization and Review, at which point all real property will be updated to the newly assessed values. The new values will be used to calculate tax bills beginning in summer 2025 and will remain in place until the next reappraisal in 2029, with a few important exceptions, such as new construction.

Appeal Representation FAQs

For Individuals, who can file appeals to the Board of Equalization and Review?

For property owned by individuals, appeals to the Board of Equalization and Review may be filed by (1) the owner, (2) an attorney licensed to practice law in North Carolina, or (3) a Power of Attorney.

For Individuals, who can represent the owner before the Board of Equalization and Review?

For property owned by individuals, owners may only be represented at the Board of Equalization Review hearings by (1) the owner, or (2) an attorney licensed to practice law in North Carolina.

For Individuals, what actions are allowed by a Power of Attorney?

For property owned by individuals, a Power of Attorney may (1) file the appeal to the Board of Equalization and Review, (2) represent the owner in appeal discussions with the Tax Office, and (3) may appear at the Board of Equalization and Review hearing as an expert witness called by the taxpayer or taxpayer’s attorney. A Power of Attorney may not represent the property owner before the Board.

For Business Entities, who can file appeals to the Board of Equalization and Review?

For property owned by a business entity, appeals to the Board of Equalization and Review may only be filed by (1) an attorney licensed to practice law in North Carolina, (2) an officer of the business entity, (3) a manager or member-manager if the business entity is a limited liability company, (4) an authorized employee of the business entity whose income is reported on IRS Form W-2, or (5) an authorized owner of the business entity, if the owner's interest in the business entity is at least twenty-five percent (25%). For all options above except (1), a Non-Attorney Representative Authorization must be filed with the Board.

For Business Entities, who can represent the owner before the Board of Equalization and Review?

For property owned by a business entity, the owner may only be represented at the Board of Equalization and Review hearings by (1) an attorney licensed to practice law in North Carolina, (2) an officer of the business entity, (3) a manager or member-manager if the business entity is a limited liability company, (4) an authorized employee of the business entity whose income is reported on IRS Form W-2, or (5) an authorized owner of the business entity, if the owner's interest in the business entity is at least twenty-five percent (25%). For all options above except (1), a Non-Attorney Representative Authorization must be filed with the Board.

For Business Entities, what actions are allowed by a Power of Attorney?

For property owned by a business entity, a Power of Attorney may (1) represent the owner in appeal discussions with the Tax Office, and (2) may appear at the Board of Equalization and Review hearing as an expert witness called by the taxpayer’s attorney or taxpayer’s authorized non-attorney representative listed above. A Power of Attorney may not file the appeal and may not represent the property owner before the Board.

Where can I find a sample Power of Attorney (POA)?

A sample Power of Attorney (POA) suitable for Durham County property tax matters only is located here: https://www.dconc.gov/home/showdocument?id=27297

What is a Business Entity?

A business entity is a corporation, a general partnership, a limited partnership, or a limited liability company.

Is the Board of Equalization and Review a quasi-judicial body? How does that affect the appeals process?

The Durham County Board of Equalization and Review is a quasi-judicial body. Filing appeals or petitions to the Board and representation of the owner before the Board may be considered the practice of law per North Carolina General Statute 84-2.1.

Why are there restrictions on Powers of Attorney for filing appeals to the Board of Equalization and Review and for representing the taxpayer before the Board?

Since the Board of Equalization and Review is a quasi-judicial body, certain actions such as filing appeals or petitions to the Board and representation of the owner before the Board may be considered the practice of law. Therefore, the Board does not allow Powers of Attorney to file appeals for business entities or to represent any owner before the Board. A Power of Attorney may (1) represent the owner in appeal discussions with the Tax Office, and (2) may appear at the Board of Equalization and Review hearing as an expert witness called by the taxpayer’s attorney or taxpayer’s authorized non-attorney representative, as neither of these actions would likely be considered the practice of law.

Why can a Power of Attorney file an appeal for an individual but not for a business entity?

Since the Board of Equalization and Review is a quasi-judicial body, certain actions such as filing appeals or petitions to the Board and representation of the owner before the Board may be considered the practice of law. Therefore, the Board does not allow Powers of Attorney to file appeals for business entities, especially since the General Assembly has specifically provided for Non-Attorney Representatives who can file appeals for business entities, per North Carolina General Statute 105-290(d2). Since no similar category has been created for individual owners, and since the filing of an appeal for an individual may or may not rise to the level of practice of law, the Board allows the filing of an appeal for an individual taxpayer. However, it is the position of the Board that representation of the owner, whether individual or business entity, before the Board will not be allowed due to the likelihood that such representation rises to the level of practice of law.